Can outsourcing truly streamline bookkeeping processes for greater efficiency in insurance consulting? Managing bookkeeping efficiently is a significant challenge for small and medium-sized insurance consulting firms, especially as the demand for precise financial records and regulatory compliance intensifies.

Outsourcing bookkeeping services presents a strategic solution, offering enhanced accuracy and considerable cost benefits.

In this article, we delve into how outsourcing to the Philippines can effectively tackle operational hurdles in insurance consulting, showcasing the exceptional quality of Filipino talent and highlighting successful case studies from Big Outsource.

The Importance of Bookkeeping in Insurance Consulting

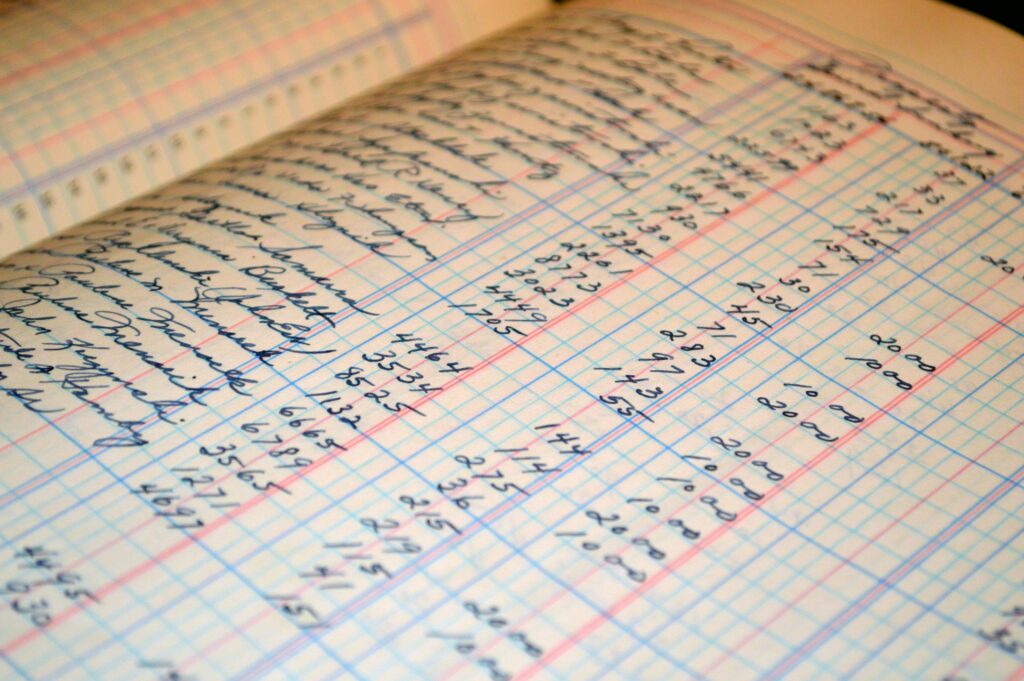

Accurate bookkeeping is the backbone of any successful insurance consulting firm. It involves meticulously tracking financial transactions, maintaining detailed records, and ensuring compliance with regulatory requirements.

Good bookkeeping helps companies keep track of their money and profits. It also helps them create accurate financial statements and annual reports. Additionally, it allows companies to follow tax rules and make smart business choices.

However, managing these tasks internally can be both time-consuming and costly. Outsourcing offers a cost-effective solution, allowing firms to concentrate on their core business activities while ensuring their financial records are in expert hands.

Why Choose the Philippines for Bookkeeping?

The Philippines has emerged as a leading global hub for outsourcing due to its highly skilled workforce, cultural alignment with Western business practices, and significant cost advantages. The country produces a substantial number of accounting and finance graduates who are adept in international accounting standards annually.

Additionally, lower labor costs in the Philippines translate to substantial savings for insurance consulting firms, while maintaining top-quality service. Filipino professionals’ strong English proficiency ensures clear communication, and their renowned work ethic guarantees reliable and high-quality output.

Types of Bookkeeping Services Offered by Filipino Experts

Filipino bookkeeping experts provide a comprehensive range of services tailored to the needs of insurance consulting firms. These services include daily transaction recording to maintain accurate financial records, accounts payable and receivable management for timely collections and disbursements, payroll processing to handle calculations and ensure compliance, and detailed financial reporting for insights into the firm’s economic health. They also assist with tax preparation and compliance to minimize the risk of penalties and audits.

How to Effectively Collaborate with Filipino Bookkeeping Teams

Successful collaboration with Filipino bookkeeping teams hinges on clear communication and strategic management. Establishing open lines of communication through video conferencing, email, and project management tools is crucial. Defining expectations, including deadlines and reporting formats, ensures alignment and effective performance.

Leveraging technology, such as cloud-based accounting software, facilitates seamless data sharing. Understanding and respecting cultural differences enhances the working relationship while providing training helps the outsourced team adapt to specific business processes and requirements.

The Future of Bookkeeping Outsourcing in the Philippines

The outsourcing industry in the Philippines is poised for continued growth, driven by advancements in technology and a skilled workforce. In the future, we will see more automation and artificial intelligence to improve accuracy and efficiency. There will also be more specialized services for insurance consulting and a greater emphasis on data security.

As the demand for bookkeeping services rises, outsourcing firms will continue to innovate and adapt to meet evolving industry requirements.

Elevate Your Financial Operations with Outsourcing

Outsourcing bookkeeping to the Philippines provides insurance consulting firms with a strategic advantage in managing their financial operations. The benefits include cost savings, access to high-quality talent, and the ability to focus on core business activities.

Big Outsource dedicates itself to offering exceptional bookkeeping services that empower clients and drive their success.

Partner with Big Outsource and experience a transformation in your operational efficiency and growth potential.